iowa first time homebuyer tax credit

Mortgage Credit Certificate Program. The account holder can make unlimited deposits each year to the homebuyer savings account.

As A First Time Home Buyer Do I Need A Down Payment On Sale Up To 51 Off Www Seo Org

Borrowers who buy their homes using the FirstHome or FirstHome Plus Homebuyer Programs may be subject to recapture tax.

. Homeowners are encouraged to consult a tax professional to calculate their credit through the Mortgage Credit Certificate. A qualifying first-time homebuyer savings account must be an interest-bearing savings account and established with a state or federally chartered bank savings and loan association credit union or trust company in Iowa. Buying a home for the first time in Iowa now comes with some perks that allow first-time homebuyers and.

8000 First-time Homebuyer Tax Credit at a Glance. Welcome to CACTAS. Iowas mortgage credit certificate program mcc allows homebuyers to save up to 2000 every year on their federal taxes for.

Eligible first time iowa home buyers can purchase a home and reduce their federal income tax liability by up to 2 000 a year for the life of their mortgage under a. Iowa First Time Homebuyer Tax Credit. Blood sweat and tears have gone into putting a first-time homebuyer program in place to help first-time homebuyers in the state of Iowa.

It has been 4 years in the works. This deduction limitation is based on the account holder so even though you may have contributed to multiple accounts for more than one beneficiary your total deduction may not exceed 2097 4195 for married. Iowa first time homebuyer tax credit.

Every year youre granted a direct credit on your federal taxes of 50 of the annual interest you pay on your mortgage. This bill would bring back the tax credit from 2008 with many of the same requirements. The program awards a tax credit valued at 50 of the annual mortgage interest paid and is available annually as long as the home remains the home buyers primary residence.

You may deduct up to 2097 4195 for married filing jointly in qualifying Iowa First-Time Homebuyer Savings Account contributions made during the tax year. CACTAS stands for Tax C redit A ward C laim and T ransfer A dministration S ystem and refers to the online system supporting the tax credit administration responsibilities of IDR and other State agencies that facilitate tax. Iowa offers first-time home buyer tax credit.

A first time homebuyer is defined as not owning a primary residence in the last three years. Before addressing repayment a brief look at the history of the homebuyer tax credit. Eligible first-time Iowa home buyers can purchase a home and reduce their federal income tax liability by up to 2000 a year for the life of their.

The Iowa Finance Authority offers homebuyers the Homes for Iowans program that helps borrowers with competitive interest rates and down payment assistance. Account holders can contribute up to 2000 or 4000 joint tax-free each year to a dedicated down payment savings account. Please note that all programs listed on this website may involve a second mortgage.

The first-time homebuyers savings account FTHSA is a special type of savings account that helps Iowans save for a first home. The bill officially passed in the Senate with a vote of 49-1 and passed in the House with a vote of 87-11. As described in Senate File 505 it includes provisions that allow individuals including those who already own a home to make tax deductible contributions into an account to be used by a designated person for certain expenses related to purchasing a.

The income tax deduction is limited to. With that loan amount and interest rate youd receive a 218 rate for the mcc program meaning youd receive a tax credit of 1640. 9 2018 at 639 AM PDT.

The Iowa Department of Revenue established a First-Time Homebuyers Savings Account or FTHSA which is a special type of bank account to help Iowans save for their home. For the tax credit program the IRS defines a first-time homebuyer as someone who has not owned a principal residence during. Mortgage Credit Certificates offer qualified Iowa home buyers up to 2000 in annual federal income tax credits DES MOINES - The Iowa Finance Authority IFA today announced that eligible first-time Iowa home buyers may purchase a home and reduce their federal income tax liability by up to 2000 a year for the life of their mortgage.

Iowas Mortgage Credit Certificate Program MCC allows homebuyers to save up to 2000 every year on their federal taxes for the life of their mortgage loan. Borrowers repay the government a portion of their gain on the sale of their home depending on 1 whether there is a gain on the sale 2 the household income at the time of sale and 3 if the sale occurs within nine years of buying the home. The original tax credit established in July of 2008 was for a maximum of 7500 for qualified first-time homebuyers who purchased a principal residence after April 8 2008 and before January 1 2009 originally before July 1 2009 prior to modification.

Governor Branstad signed the bill into law Tuesday May 9 2017 and it went into effect January. Iowa first-time homebuyers get tax break. The First-Time Homebuyer Act of 2021 was introduced by several Democratic members of Congress in April 2021.

The 8000 tax credit is for first-time homebuyers only. The short answer is unfortunately no.

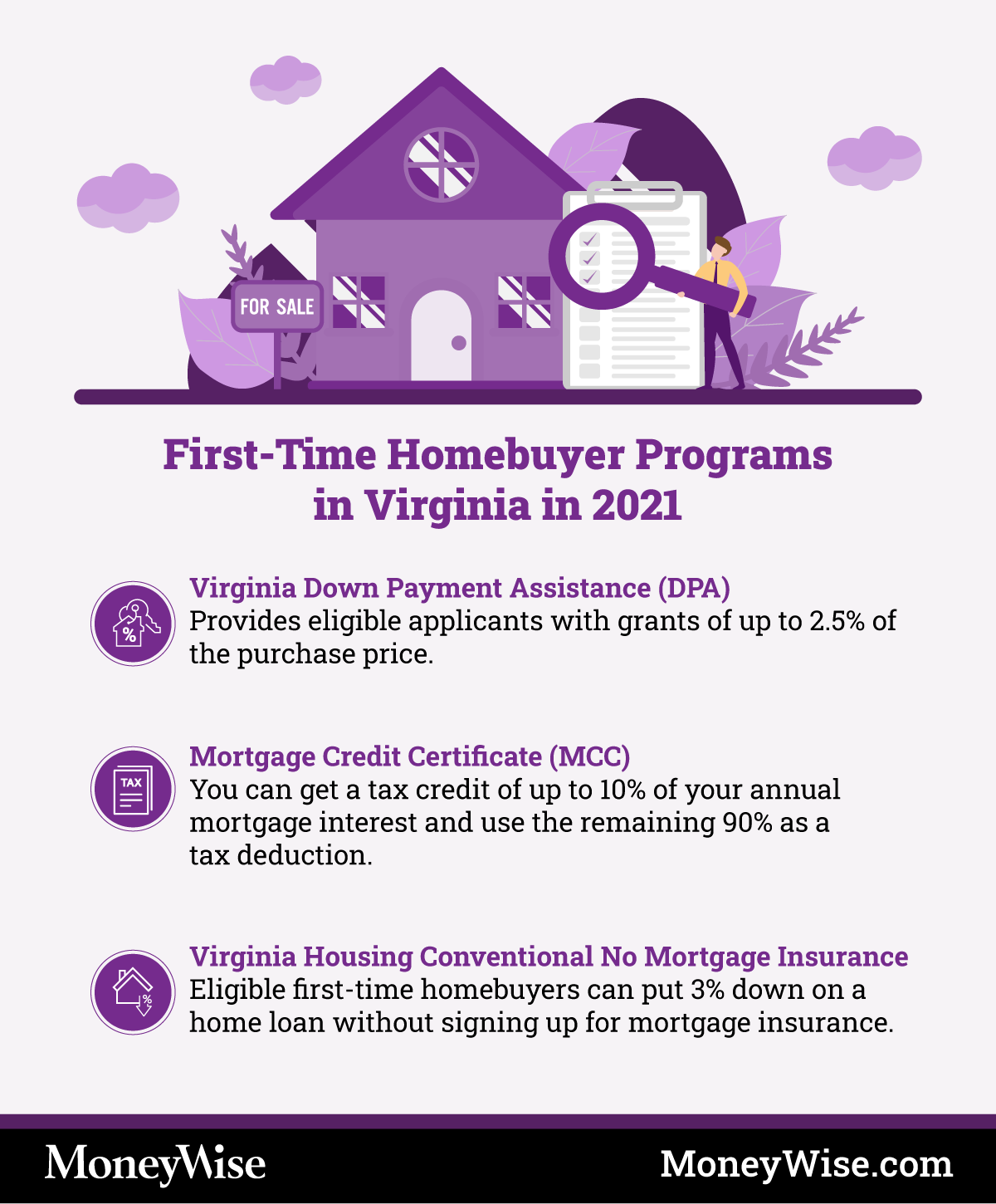

Virginia First Time Homebuyer Programs 2022

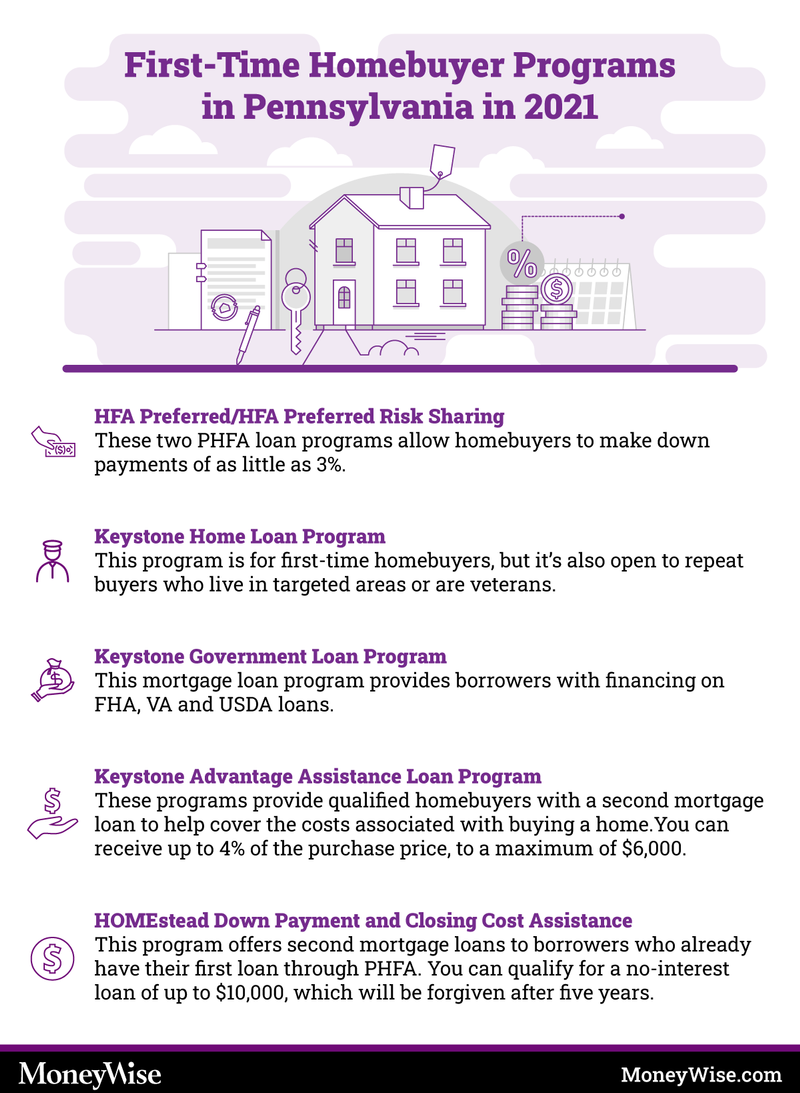

Pennsylvania First Time Homebuyer Programs For 2022

The 5 C S Of Credit And What They Mean For Your Agricultural Land Loan Agamerica Land Loan The Borrowers Credits

Iowa Ia First Time Home Buyer Programs For 2019 Smartasset

As A First Time Home Buyer Do I Need A Down Payment On Sale Up To 51 Off Www Seo Org

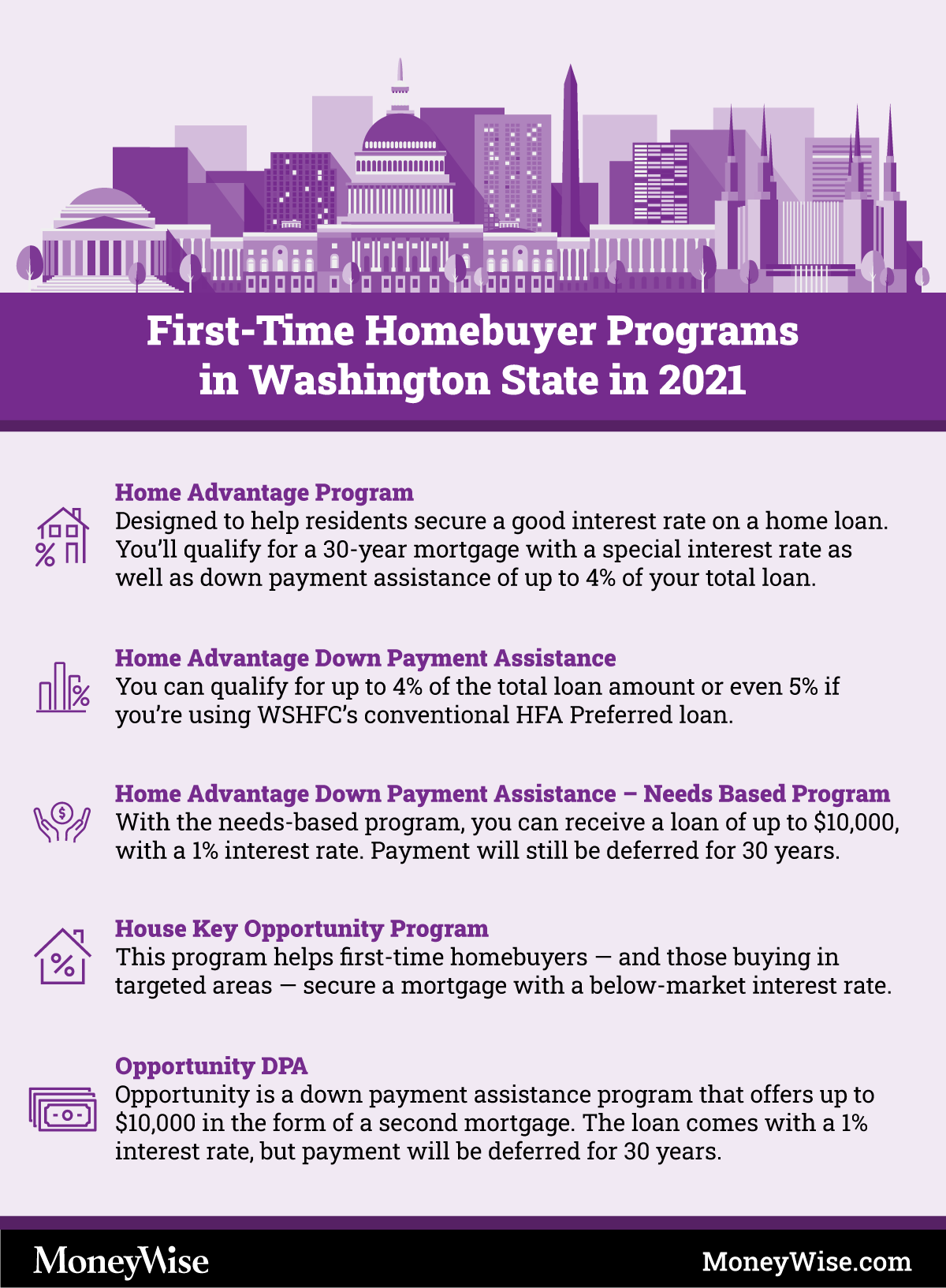

First Time Homebuyer Programs In Washington State 2022

As A First Time Home Buyer Do I Need A Down Payment On Sale Up To 51 Off Www Seo Org

First Time Homebuyer Programs In Ohio 2022

First Time Homebuyer Programs In Arizona 2022

What Is Biden S 15 000 First Time Homebuyer Act

As A First Time Home Buyer Do I Need A Down Payment On Sale Up To 51 Off Www Seo Org

Common Mistakes That First Time Home Buyers Make Buying First Home First Time Home Buyers Buying Your First Home

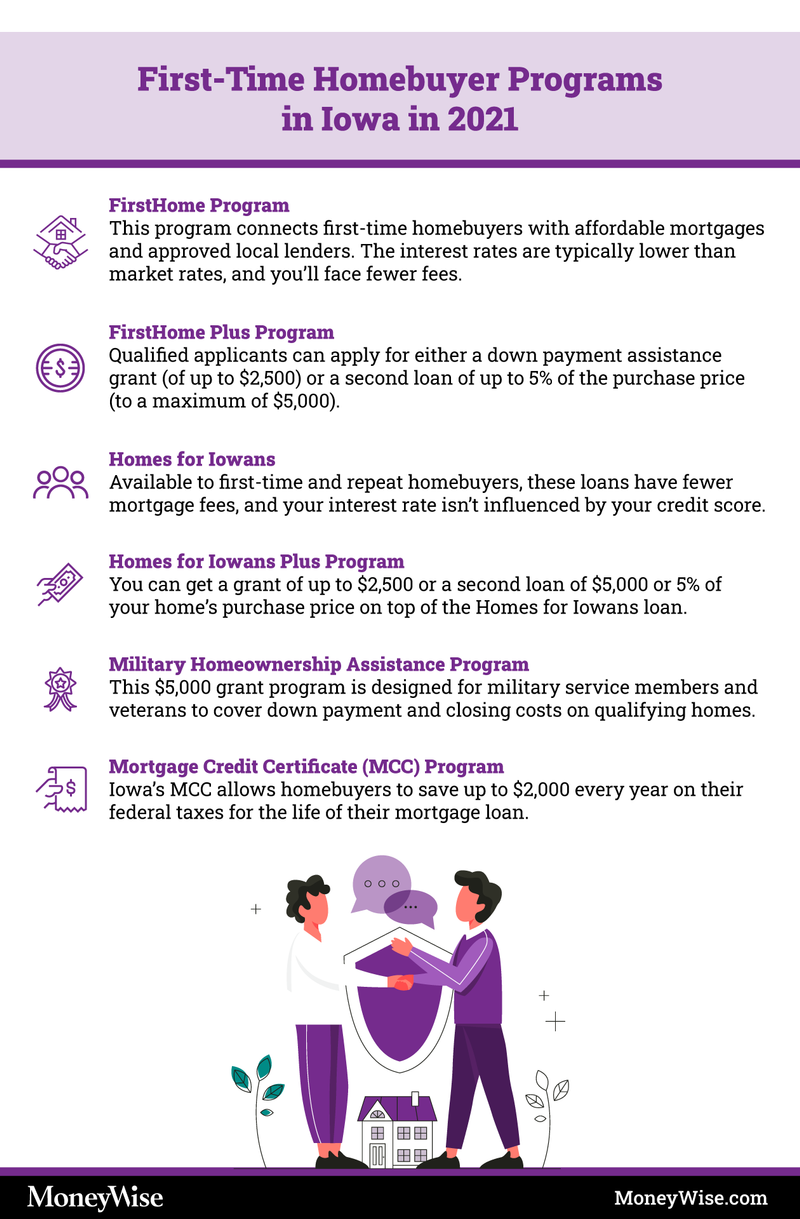

First Time Homebuyer Programs In Iowa 2022

Tips For First Time Home Buyers What You Must Know Before You Buy

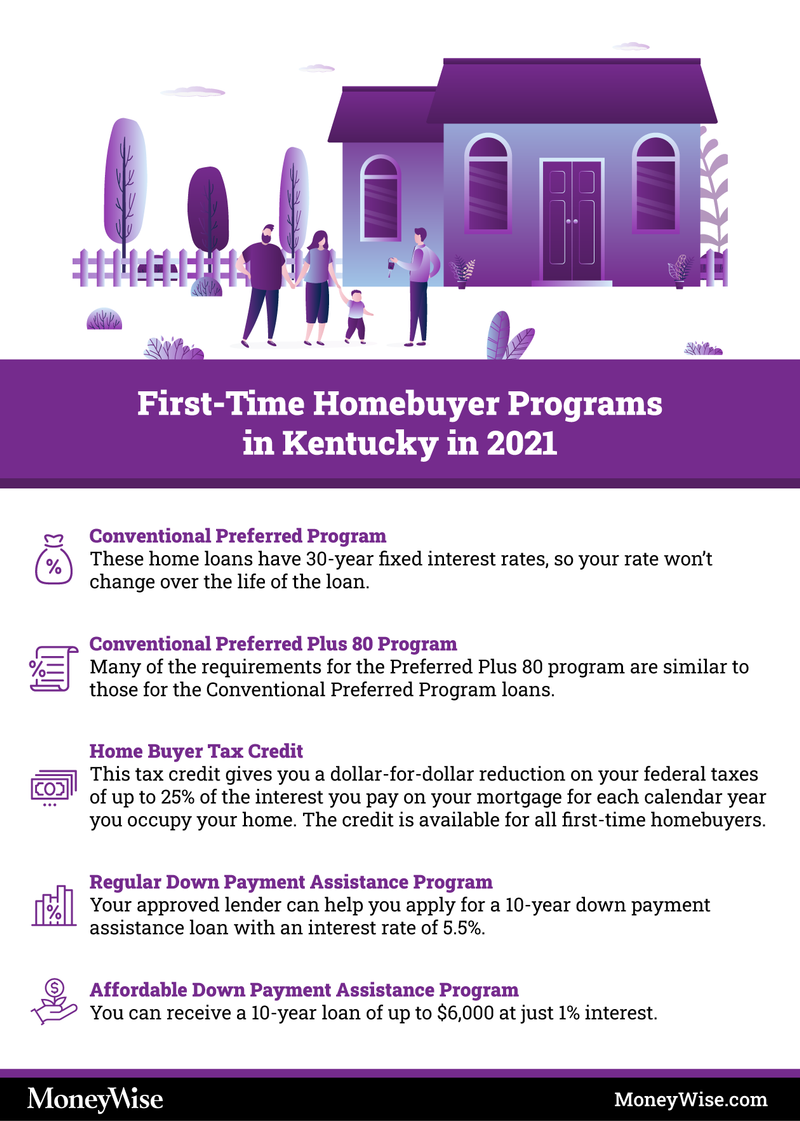

First Time Homebuyer Programs In Kentucky 2022

First House Buying A Home Homeowner Tips For First Timer Prequalified Mortgage Lenders Comparing Interest Rates

As A First Time Home Buyer Do I Need A Down Payment On Sale Up To 51 Off Www Seo Org

What If My Co Purchaser And I Don T Both Qualify As First Time Homebuyers Ratehub Ca

As A First Time Home Buyer Do I Need A Down Payment On Sale Up To 51 Off Www Seo Org

0 Response to "iowa first time homebuyer tax credit"

Post a Comment